We’ve all read about billionaires becoming so much richer over the past two decades.

And we see the headlines about billionaires buying stuff that only they can afford.

In 2012, Oracle CEO Larry Ellison purchased 98% of the Hawaiian island of Lanai. The $300 million purchase included two Four Seasons resorts, two championship golf courses, and 88,000+ acres of land.

Mark Zuckerberg owns at least three yachts, a 387-foot, $300 million mega-yacht and two smaller (but not small) vessels, the last one acquired in early 2024. His three boats have a combined value of $430 million.

Mark Walter, current owner of the Los Angeles Dodgers, is in the process of buying the Los Angeles Lakers for a record $10 billion.

And now Congress is weighing a tax cut to help these guys out.

Last month, Beinsure Media published a ranking of U.S. billionaires. Elon Musk topped the list with a staggering net worth of $386 billion. Mark Zuckerberg followed with $227 billion, Jeff Bezos at $226 billion, Larry Ellison at $190 billion, and Bill Gates was fifth at $174 billion. The 100th richest person on the list, Henry Samueli, has a net worth of $20.5 billion.

Let’s use Mr. Samueli to illustrate just how vast that kind of wealth is.

Imagine that Samueli decides to spend $1 million every single day. In one year, he’d still have more than $20 billion left. He could keep that pace for 50 years and still be a billionaire. If you apply that example with Elon Musk’s numbers, Musk could spend $1 million per day for 1,057 years.

According to the U.S. Federal Reserve, the average net worth for the bottom 50% of Americans is $23,588. I understand that people should save more, invest wisely, and avoid financial mistakes. But I also understand that life is not always fair, and wealth isn’t always the reward for hard work and discipline.

Yet, lawmakers are planning to lessen the obligations for people with private islands, rockets, and boats with helicopter landing pads.

How much is enough? Does Congress need to provide more tax loopholes, more government subsidies, more no-bid contracts?

And it’s not just Congress that’s guilty. As a culture, we’ve become obsessed with huge numbers. In 2025, the Mega Millions lottery raised their ticket prices from $2 to $5 so they can offer a few more winners, but mostly so they could increase the jackpot sizes. A $10 million win apparently isn’t “life-changing” enough anymore.

Americans crave billion-dollar prizes. But what if the lottery created 1,000 millionaires instead of one billionaire? Wouldn’t that change more lives, spread more hope, create more opportunities? I’d be happy with a mil.

Congress could take the same suggestion. Instead of funneling trillions in tax breaks to billionaires and to their businesses, they might work on funding universal childcare, expanding affordable healthcare instead of cutting it, and ensuring access to higher quality education?

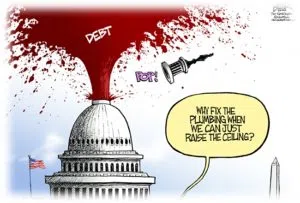

Or maybe, dare we think, they could pay something against the national debt? At the current $37 trillion debt level, some people have predicted that it could cause our children and our grandchildren problems during their lifetimes; just maybe. Yet, Congress seems to care much less about that than reelection, continuing to kick that can down the road for the next set of lawmakers.

Whether taxes get cut or not, Elon Musk will be OK. Zuckerberg, and even Samueli, will be fine.

Let’s stop rewarding wealth-hoarding and start being fiscally responsible. Let’s help everyone, and let’s start paying our debts. If you can spend $1 million a day for 1,000 years, you’re probably not paying much in taxes anyway.

As Warren Buffet said, at his company’s 2024 annual meeting, federal taxes could be effectively zero for every American if eight hundred companies had paid their fair share of taxes (his company paid over $5 billion at a 21% federal rate for 2023). Buffet noted that his company’s $26.8 billion federal tax bill in 2024 was the equivalent of 5% of all corporate taxes owed that year.

Buffet has advocated for more equitable tax laws for years, making headlines in 2012 when he revealed that his secretary, Debbie Bosanek, paid a far higher tax rate than he did. He told ABC News, “Debbie works just as hard as I do and she pays twice the rate I pay. I think that’s outrageous.”

Hard to argue.

Curt MacRae, a resident of Coldwater, MI, publishes regular opinion columns

To be notified by email when a column is published, or to offer feedback email rantsbymac@gmail.com

Comments